On April 21st, 2021, the European Union (EU) Commission announced the adoption of the Corporate Sustainability Reporting Directive (CSRD) as part of its commitment to the European Green Deal. The CSRD revised the Non-Financial Reporting Directive (NFRD) and significantly increased reporting requirements for companies within its scope to enhance the availability of sustainability information for users.

The CSRD establishes a unified reporting framework that enhances the quality and depth of sustainability information. It aims to boost the credibility of firms among stakeholders such as investors, banks, customers, and consumers.

Companies Under the Scope of the CSRD

The application of the CSRD will take place in four stages:

- As of 1st January 2024, companies falling under the scope of the NFRD – i.e., public interest entities employing more than 500 people (reporting in 2025 on the financial year of 2024),

- As of 1st January 2025, large companies that exceed two of the three criteria met (reporting in 2026 on the financial year of 2025):

- 250 employees,

- €25 million on the balance sheet,

- €50 million net turnover.

- As of 1st January 2026, for listed small and medium-sized enterprises (SMEs) (reporting in 2027 on the financial year of 2026),

- As of 1st January 2028, for certain non-EU companies that meet one of the following criteria (reporting in 2029 on the financial year of 2028):

- Listed on an EU-regulated market with securities,

- Generate annual EU revenue surpassing €150 million with an EU branch annual net turnover of €40 million,

- Generate annual EU revenues exceeding €150 million and own an EU subsidiary considered a “large company”.

ESRS: The New Benchmark for Sustainability Reporting in Europe

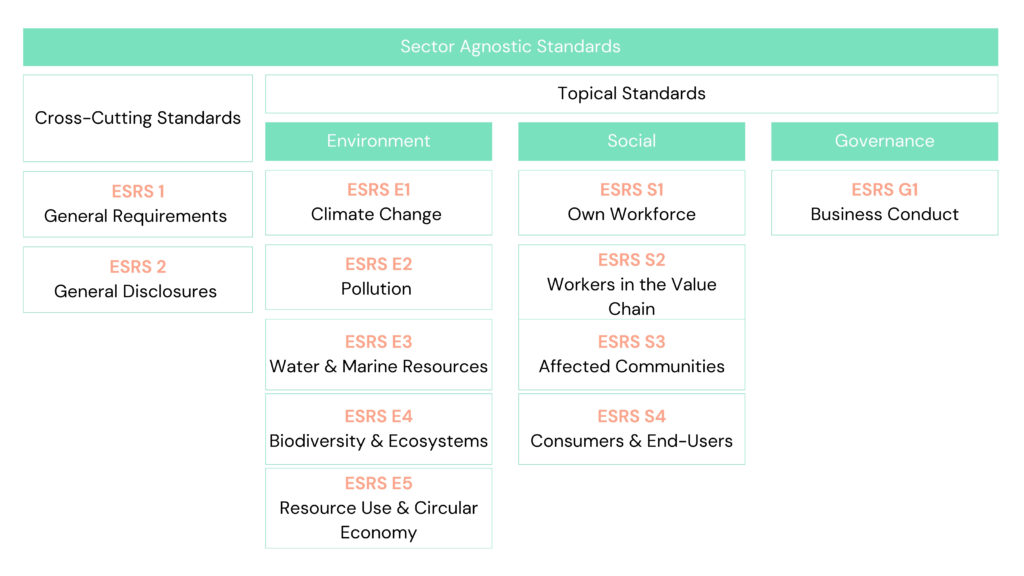

In 2022, the European Financial Reporting Advisory Group (EFRAG) introduced its initial set of European Sustainability Reporting Standards (ESRS). The ESRSs define the metrics companies need to report and how to report to meet the CSRD disclosure requirements. In December 2023, the ESRSs were published in the Journal of the EU as legally binding.

In total, there are twelve ESRSs, which detail disclosures and metrics. These twelve standards are sector-agnostic, consisting of two cross-cutting standards and ten topical standards. All the standards are mandatory for companies falling under the CSRD. However, while the ten topical standards are mandatory, the specific disclosures within these standards are subject to the materiality assessment. In contrast, the cross-cutting standards are mandatory in their entirety and are not subject to the materiality assessment.

Double Materiality in CSRD: Broadening Disclosure Requirements

All CSRD reporting must adhere to the principle of double materiality. This requires organisations to report on both impact materiality and financial materiality.

Impact materiality also known as the “inside-out perspective” focuses on the impact of a company on the environment and society, such as the impact of a company’s greenhouse gas emissions on the environment. On the other hand, financial materiality, also known as the “outside-in perspective” considers the impact of sustainability matters on the company, for example, the financial impact on a company as a result of the introduction of a carbon tax.

Third-Party Auditing

The CSRD mandates third-party auditing and assurance of the sustainability information and data contained in the report. Initially, compliance will entail auditors offering limited assurance, primarily based on the organisation’s own statements. However, within the next three years, the CSRD will implement a requirement for reasonable assurance, relying on the auditor’s examination and comprehension of the organisation’s operations, processes, and controls.

Importance of Compliance with the CSRD

Adherence to the CSRD emerges as a cornerstone of modern business practice. By mandating transparent reporting and auditing, the CSRD cultivates trust among stakeholders and facilitates informed decision-making in alignment with sustainability goals. As businesses navigate the transition towards a sustainable future, compliance with the CSRD serves as a beacon guiding them towards responsible and accountable practices, driving positive impacts on both society and the environment.

How Can We Help

At Zampa Partners we specialise in providing comprehensive support for your company’s sustainability journey. We create ESG strategies tailored to your company’s product lines, value chain, and overarching ESG values, vision, and long-term goals. Our team conducts materiality assessments and plots materiality matrices to identify key areas of focus, we measure the company’s baseline and help develop Key Performance Indicator’s (KPIs).

In our detailed ESG strategy reports, you’ll find summaries of material ESG issues, KPIs, action plans, and governance frameworks. Additionally, we provide expert assistance with reporting to ensure full compliance with the CSRD and ESRS requirements.

Mark Wirth

Partner